As part of its investor presentation earlier this week, R.R. Donnelley announced plans to split into three publicly traded companies, each with a different focus. These companies will be Customized Multi-Channel Communications (CMCo), Financial Communications Services (FinancialCo), and Publishing & Retail-Centric Print (PRSCo). Describing the move as a “transformative separation,” R.R. Donnelley positions this as the next stage in the company’s evolution from a print and ship model to a multi-channel communication services model that leverages data analytics, content optimization and multi-channel marketing.

The transaction will take the form of a tax-free spin-off of the financial and publishing/retail components and is expected to be completed by the end of 2016. The customized multi-channel media communications component will retain R.R. Donnelley’s outstanding notes/debt and will receive cash proceeds from the sales of the two other components. Existing R.R. Donnelley shareholders will end up owning shares in all three companies. No specifics were provided in regard to the management teams for each component. That will come later.

R.R. Donnelley has net sales of about eleven and a half billion dollars. The three planned companies break out as follows:

- Customized Multi-Channel Communications (CMCo) – $7.0 billion: CMCo has two major sub-components: Product Promotion & Logistics and Variable Print. Commercial and digital print account for the largest shares of these businesses, which also include direct mail, business process outsourcing and R.R. Donnelley’s Asia operations. Growth in net sales for this part of the business was 2.6 percent from 2012 to 2014.

- Financial Communications Services (FinancialCo) – $1.0 billion: FinancialCo includes Donnelley’s financial print and related services. This includes Edgar Online, which was acquired in 2012. The FinancialCo segment had growth in net sales of 1.4 percent from 2012 to 2014.

- Publishing & Retail-Centric Print (PRSCo) – $3.5 billion: PRSCo includes Donnelley’s catalog, magazine, book, inserts, directory and office product areas. This core area of R.R. Donnelley’s traditional business had a decline in net sales of -3.1 percent from 2012 to 2014.

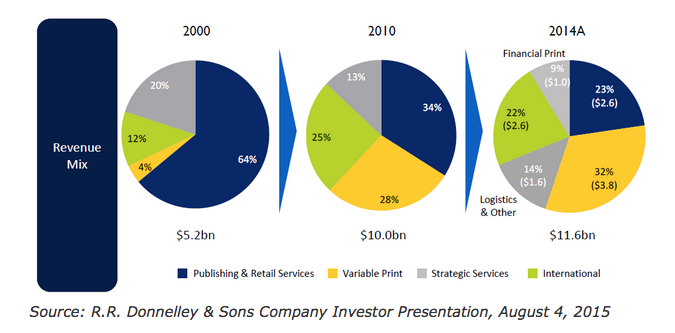

Business mix has changed dramatically for R.R. Donnelley since 2000, when it was a $5.2 billion entity. Publishing and Retail Services made up about two-thirds of the company’s business then. That business has shrunk, and now makes up only about 23 percent of revenue. Variable Print has grown in importance since 2000 when it accounted for only about 4 percent of revenue. In 2014 it was a $3.8 billion business accounting for nearly a third of total R.R. Donnelley revenues. This growth has been fueled by acquisitions such as CGX and Esselte NA in 2014, Cardinal in 2007 and Moore Wallace in 2004.

The announcement of the split comes amidst less than joyous second quarter 2015 earnings news. Donnelley’s revenues declined -5.3 percent compared to the same quarter in 2014. Net income declined from $64.7 million in the second quarter of 2014 to $43.5 million in the second quarter of 2015. As Donnelley looks to the future it must balance the challenges of the traditional printing market with the growth opportunities inherent in customized multi-channel communications. It’s not an easy balancing act. Thomas Quinlan III, R.R. Donnelley’s president and CEO, says that the company will “continue to aggressively manage costs.” Employees know that this means there will be plant closings and layoffs.

In the wake of the announcement at least one financial market observer notes that R.R. Donnelley is modeling what it is doing on companies like HP, eBay and Symantec, which have already announced decisions to split in the hope that the resulting smaller entities will have better financial strength, higher shareholder value and perhaps even improved stock market performance. This is quite a modern move for a company that recently celebrated its 150th anniversary. For many observers of the printing market, the important aspect will be the impact on individual R.R. Donnelley sites and what that means for their future. Donnelley’s unprecedented acquisition spree since 2000 has left many in awe of this market giant’s impact. At least for now it appears that the up-sizing is over, and that the focus will be on allowing the smaller groups to tailor their business opportunities appropriately, consider organic growth possibilities, and capitalize on industry trends and opportunities.

PCI Hosts Annual Client Innovation Summit

PCI Hosts Annual Client Innovation Summit

Has the Tariff War Brought Highcon to Bankruptcy?

Has the Tariff War Brought Highcon to Bankruptcy?

Larisa Teply's Secrets to Success in the Print Industry

Larisa Teply's Secrets to Success in the Print Industry

Embracing Technology and Redefining Print with Wendi Breuer

Embracing Technology and Redefining Print with Wendi Breuer

Xplor International Closes After 40-Plus Years

Xplor International Closes After 40-Plus Years

Exploring Career Growth and Innovation with Shannon Romeo

Exploring Career Growth and Innovation with Shannon Romeo