Deluxe Reports Q2 Revenue Increase of 7.5 Percent, Exceeding High End of Outlook

ST. PAUL, Minn.—Jul. 27, 2015—Deluxe Corp., a leader in providing small businesses and financial institutions with products and services to drive customer revenue, announced its financial results for the second quarter ended June 30, 2015. Key financial highlights include:

Both revenue and diluted EPS exceeded the high end of the range in the prior outlook driven by strong operating results in all three segments and earlier than expected cost savings.

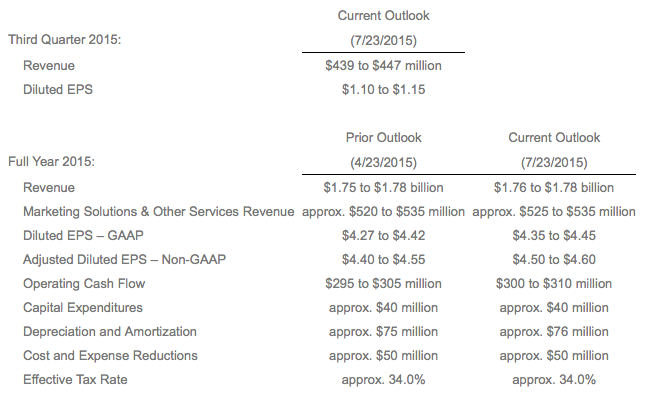

“Deluxe delivered an outstanding second quarter, beating both our revenue and earnings outlook,” explained Lee Schram, CEO of Deluxe. “We continue to execute our transformation strategy and are pleased with the growth we see in our marketing solutions and other services product categories. We believe we have the right strategy in place to continue to grow our business and as a result of our first half performance, have raised our full year earnings and operating cash flow outlook.”

Second Quarter 2015 Highlights:

- Revenue increased 7.5 percent year-over-year, primarily due to the Financial Services segment which grew 19.1 percent and included the results of Wausau Financial Systems which was acquired in Oct. 2014. Additionally, the Small Business Services segment grew 5.5 percent.

- Revenue from marketing solutions and other services increased 31.0 percent year-over-year and accounted for 29.0 percent of consolidated revenue in the quarter.

- Gross margin was 64.2 percent of revenue, up from 64.0 percent in the second quarter of 2014. The increase was primarily driven by previous price increases, an increase in service margins and improvements in manufacturing productivity, partially offset by product revenue mix and increased delivery and material costs.

- Selling, general and administrative (SG&A) expense increased 9.6 percent from last year primarily due to additional SG&A expense from acquisitions but was partially offset by continued cost reduction initiatives in all segments. SG&A as a percent of revenue was 43.6 percent in the quarter compared to 42.8 percent last year.

- Operating income increased 4.6 percent year-over-year and includes restructuring and transaction-related costs in both periods. Adjusted operating income, which excludes these items, increased 5.0 percent year-over-year from higher revenue and continued cost reductions.

- Diluted EPS increased 12.1 percent year-over-year. Excluding restructuring and transaction-related costs in both periods, adjusted diluted EPS increased 11.9 percent year-over-year driven by stronger operating performance and lower interest expense, partly offset by a higher effective income tax rate.

Segment Highlights

Small Business Services

- Revenue was $282.3 million and increased 5.5 percent year-over-year due to growth in marketing solutions and other services and in our online, Safeguard distributor, major account and dealer channels. Previous price increases also benefitted the quarter while unfavorable foreign exchange rates negatively impacted revenue growth by approximately 0.9 percentage points year-over-year.

- Operating income decreased 1.2 percent from last year to $48.2 million. Adjusted operating income, which excludes restructuring and transaction-related costs in both periods, decreased 0.2 percent year-over-year due primarily to planned higher brand awareness marketing and investments in other revenue-generating initiatives, partly offset by cost reductions.

Financial Services

- Revenue was $112.7 million and increased 19.1 percent year-over-year. The increase in revenue was primarily due to growth in marketing solutions and other services, which includes Wausau Financial Systems revenue of approximately $19 million, as well as the impact of previous price increases, partially offset by the secular decline in check usage.

- Operating income increased 14.3 percent from last year to $25.5 million. Adjusted operating income, which excludes restructuring costs and transaction-related costs, increased 13.7 percent year-over-year, reflecting previous price increases and the continued benefits of cost reductions, partially offset by the secular decline in check usage.

Direct Checks

- Revenue of $40.9 million declined 5.1 percent year-over-year due primarily to the secular decline in check usage and the elimination of marketing expenditures that no longer met the Company’s return criteria, partially offset by higher conversion rates from email marketing offers and an improved call center incentive plan.

- Operating income increased 9.4 percent year-over-year to $15.2 million due to a higher mix of reorders and lower costs which more than offset lower order volume.

Other Highlights

- Cash provided by operating activities for the first half of 2015 was $146.0 million, an increase of $20.2 million compared to 2014, driven primarily by improved operating performance, timing of collections associated with the Wausau business and lower interest payments, partially offset by higher performance-based compensation payments.

- At the end of the second quarter, the company had $233 million drawn on its credit facility, a short-term bank loan of $75 million and $194.8 million of long-term debt outstanding.

About Deluxe Corp.

Deluxe is a growth engine for small businesses and financial institutions. Nearly 4.6 million small business customers access Deluxe’s wide range of products and services including customized checks and forms, as well as Website development and hosting, search engine marketing, search engine optimization, and logo design. For financial institutions, Deluxe offers industry-leading programs in checks, customer acquisition and loyalty, fraud prevention and profitability and financial technology solutions including receivables management. Deluxe is also a leading printer of checks and accessories sold directly to consumers.

Source: Deluxe Corp.