STAMFORD, Conn.—July 30, 2015—Pitney Bowes, a global technology company that provides products and solutions that power commerce, today reported financial results for the second quarter 2015.

Quarterly Financial Results:

- Revenue of $881 million, a decline of 4 percent on a constant currency basis and a decline of 8 percent as reported. Revenue declined 3 percent versus the prior year when adjusted for the impacts of currency and the divestiture of certain European revenue streams in the prior year.

- Adjusted EPS of $0.45; GAAP EPS of $0.75. Adjusted EPS includes a $0.02 negative impact for currency translation during the quarter.

- Free cash flow of $84 million; GAAP cash from operations of $96 million.

- Established new segment reporting.

- Increasing annual GAAP EPS guidance as a result of the net gain on the sale of Imagitas; partially offset by costs associated with the Borderfree acquisition; restructuring and asset impairment charges; and other expenses.

- Updating revenue guidance to reflect results year-to-date.

- Updating annual adjusted EPS and free cash flow guidance solely to reflect the impacts of the Borderfree acquisition and Imagitas sale.

Transactions Completed During the Quarter

- Acquisition of Borderfree for approximately $400 million, inclusive of transaction fees and net of cash on Borderfree’s balance sheet.

- Sale of the Marketing Services business, Imagitas, which will generate net proceeds of approximately $270 million, net of transaction fees, cash on their balance sheet and taxes when paid.

- Sale of former World Headquarters building for $39 million.

"We are at an inflection point in our transformation where the cumulative effects of the steps we have taken over the past 30 months position us for long-term growth and profitability," said Marc Lautenbach, president and CEO of Pitney Bowes. "While we continued to make progress on our way to transform Pitney Bowes, our second quarter financial results were mixed. Our Presort Services business performed well and our North American Small and Medium Business continued to improve. However, growth in our Ecommerce business was negatively affected by the strong dollar and our performance in Europe was below our expectations.

“That said, the actions we have taken over the last two years have strengthened our hand and improved our competitive position. As a result, we are poised for sustained improvement in the second half and beyond. For this reason, we will begin executing our authorized share repurchase program with the intent to complete the program by the end of this year.”

Second Quarter 2015 Revenue Results

Revenue totaled $881 million, a decline of 4 percent on a constant currency basis and 8 percent on a reported basis versus the prior year. For comparative purposes, revenue would have declined 3 percent compared to the prior year when the current and prior periods are adjusted for the impacts of currency and the reduction in revenue resulting from the exit of direct operations in some European countries that we completed in the third quarter of 2014.

Digital Commerce Solutions revenue, which excludes marketing services from both periods, grew 4 percent on a constant currency basis and was flat to prior year on a reported basis. Revenue on a constant currency basis benefited from growth in ecommerce and shipping solutions, which was offset by a decline in software solutions.

Enterprise Business Solutions revenue declined 2 percent on a constant currency basis and 5 percent on a reported basis. Revenue benefited from continued growth in Presort Services while revenue in Production Mail declined.

Small and Medium Business (SMB) Solutions revenue declined 6 percent on a constant currency basis and 11 percent on a reported basis. For comparative purposes, revenue would have declined 4 percent when adjusted for the impacts of currency and the divested revenues in Europe from the prior year.

Other revenue, which was primarily attributable to marketing services, declined 26 percent when compared to the prior year. The decline is a result of only two months of reported revenue this quarter due to the sale of this business completed in May versus a full quarter of revenue in the prior year.

Second quarter 2015 EPS Results

On a Generally Accepted Accounting Principles (GAAP) basis, earnings per diluted share were $0.75. Adjusted earnings per diluted share were $0.45 and exclude:

- $0.44 per share of Other income due to the net gain from the sale of Imagitas;

- $0.05 per share of Other expense for the resolution in principle of an outstanding legal matter and transaction costs and fees related to the Borderfree and Imagitas transactions;

- $0.04 per share of compensation expense related to the vesting of options associated with the Borderfree acquisition; and

- $0.04 per share for Restructuring and asset impairment charges.

The Company achieved its earnings per share despite the inclusion of $0.03 in reductions related to currency translation, loss of one month of Imagitas earnings and one month of amortization of intangibles related to Borderfree. The Company continued to reduce SG&A versus the prior year despite on-going investments in the business.

The Company’s earnings per share results for the quarter are summarized in the table below:

* The sum of the earnings per share may not equal the totals above due to rounding

Second Quarter 2015 Free Cash Flow Results

Free cash flow during the quarter was $84 million and $96 million on a GAAP basis. In comparison to the prior year, second quarter free cash flow was lower primarily due to the timing of working capital requirements; lower Reserve Account deposits and less of a decline in finance receivables as a result of a stabilizing portfolio. During the quarter, the Company used cash to pay $47 million in dividends to its shareholders, made $9 million in restructuring payments and received $39 million of cash related to the sale of our former World Headquarters building.

Business Segment Reporting

The Company has revised its business segment reporting for its Digital Commerce Solutions segment. The Company’s business segment reporting reflects the clients served in each market and the way it manages these segments for growth and profitability. The reporting segment groups are the SMB Solutions group; the Enterprise Business Solutions group; the Digital Commerce Solutions group; and the Other segment.

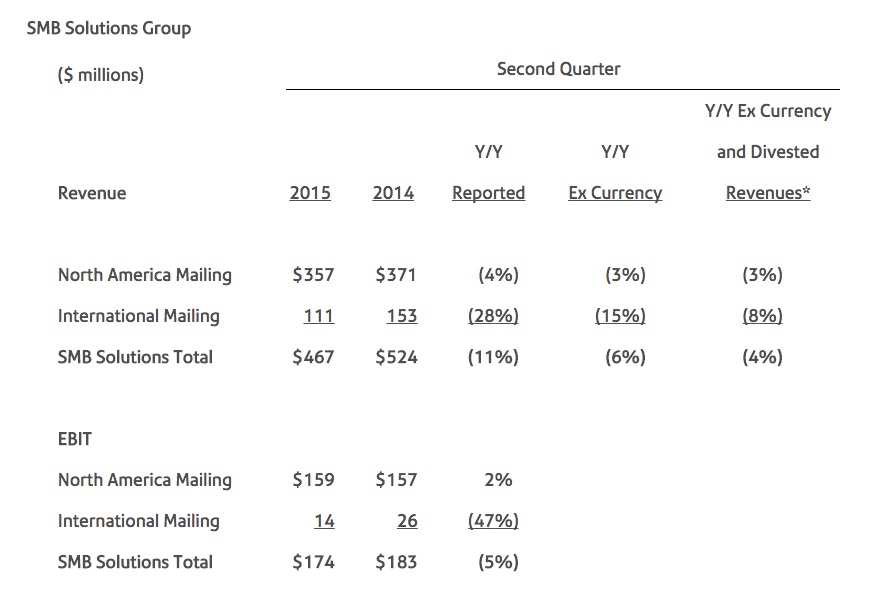

The SMB Solutions group offers mailing equipment, financing, services and supplies for small and medium businesses to efficiently create mail and evidence postage. This group includes the North America Mailing and International Mailing segments. North America Mailing includes the operations of U.S. and Canada Mailing. International Mailing includes all other SMB operations around the world.

The Enterprise Business Solutions group provides mailing and printing equipment and services for large enterprise clients to process mail, including sortation services to qualify large mail volumes for postal worksharing discounts. This group includes the global Production Mail and Presort Services segments.

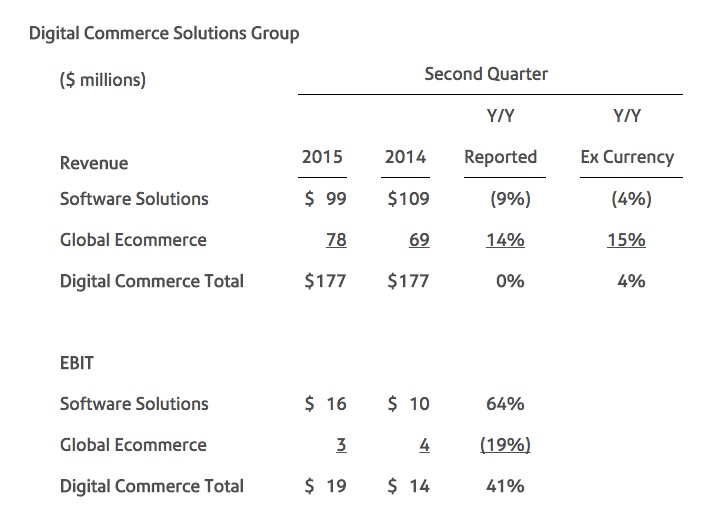

The Digital Commerce Solutions group provides customer engagement, customer information and location intelligence software; and solutions that facilitate global cross-border ecommerce transactions and shipping solutions for businesses of all sizes. This group includes the Software Solutions and Global Ecommerce segments.

The Other segment includes marketing services, which was sold on May 29, 2015.

* Excludes the impacts of currency and the divested revenues in Europe related to the exit of a non-core product line in Norway and transition to a dealer sales network in six smaller European markets completed in the third quarter of 2014.

North America Mailing

The decline in revenue for the quarter was the lowest rate of decline in five quarters, reflecting a continuation of the stabilization in results. Equipment sales declined at a low-single digit rate as the disruption from the change in go-to-market subsides and the sales organization becomes more productive. Recurring revenue stream trends were in-line with prior quarters. EBIT margin improved versus the prior year due to the mix of business, organizational streamlining and on-going cost reduction initiatives.

International Mailing

During the quarter, currency adversely affected the decline in revenue by 13 percentage points. For comparative purposes, revenue would have declined 8 percent when adjusted for the impacts of currency and the reduction in revenue resulting from the exit of direct operations in some European countries completed in the third quarter of 2014.

Results continued to be impacted by the implementation of the go-to-market initiative. All major markets, except France, have completed the go-to-market resource shift and are focused on improving productivity. France has completed its consultation phase and is expected to complete its go-to-market transition in the third quarter. Revenue comparison was also adversely impacted by the timing of postal rate changes in a number of countries.

EBIT margin declined versus the prior year primarily due to lower mail finishing equipment sales, the impact of currency on some supply chain costs and the timing of postal rate changes.

* Excluding the impacts of currency and the divested revenues in Europe related to the transition to a dealer sales network in six smaller European markets completed in the third quarter of 2014.

Production Mail

Revenue declined during the quarter due to lower support services revenue and fewer equipment sales in Europe and Asia. U.S. equipment sales grew as a result of an increase in the number of inserting equipment installations. EBIT margin improved versus the prior year due to a favorable geographic mix and higher-margin equipment sales, as well as on-going cost reduction initiatives.

Presort Services

Revenue benefited from higher volume of First Class mail processed versus the prior year. EBIT margin improved versus the prior year due to the revenue growth and on-going operational productivity.

Software Solutions

Revenue was impacted by lower licensing and services sales in Europe and Asia Pacific, which offset growth in licensing revenue in the Americas. However, as a result of go-to-market initiatives and new product introductions, the business is signing on a larger number of quality, mid-sized deals, which will reduce dependency on one-time large deals and drive new client acquisition. EBIT margin improved as a result of greater channel efficiency and consistency, as well as focused cost reduction initiatives to streamline the operations.

Global Ecommerce

Revenue includes the Borderfree acquisition late in the quarter and expansion of the eBay UK outbound cross-border service. However, outbound package shipments from the U.S. continued to be pressured by the strong U.S. dollar. Shipping solutions revenue strengthened as a result of additional new clients. The shipping business is also benefiting directly from improvements in the SMB channel that markets its solutions to mid-sized companies.

EBIT margin was impacted by on-going operational costs and integration investments related to the Borderfree acquisition as well as continued investment in the Company’s cross-border platforms.

As a result of the sale of the marketing services business in May, the Company recognized only two months of reported revenue this quarter versus a full quarter of revenue in the prior year.

2015 Guidance

This guidance discusses future results, which are inherently subject to unforeseen risks and developments. As such, discussions about the business outlook should be read in the context of an uncertain future, as well as the risk factors identified in the safe harbor language at the end of this release and as more fully outlined in the Company's 2014 Form 10-K Annual Report and other reports filed with the Securities and Exchange Commission.

The Company expects trends in the business to improve in the second half of the year versus the first half of the year as a result of recent actions taken to position the portfolio for growth, including go-to-market improvements, new product launches, client wins and partnerships.

Based on year-to-date results and the Company’s expectation of constant currency revenue growth of 1 percent to 5 percent in the second half of the year, the Company is adjusting its annual revenue guidance. The Company now expects revenue to be in the range of a 1 percent decline to 1 percent growth when compared to 2014 on a constant currency basis.

The Company is increasing its annual GAAP EPS guidance to be in the range of $2.06 to $2.21. This guidance includes the following:

- $0.44 per share of Other income related to the net gain from the sale of Imagitas;

- $0.05 per share of Other expense for the resolution in principle of an outstanding legal matter and transaction costs and fees related to the Borderfree and Imagitas transactions;

- $0.04 per share of Restructuring and asset impairment charges;

- $0.04 per share of compensation expense related to the vesting of options associated with the Borderfree acquisition;

- $0.06 per share of reduced earnings as a result of the sale of Imagitas; and

- $0.04 per share of reduced earnings related to Borderfree, which includes principally amortization of intangibles and integration investments net of early savings from expected synergies.

The Company is updating its adjusted EPS and free cash flow guidance solely to reflect the impacts of the Borderfree acquisition and Imagitas sale.

- Adjusted EPS is now expected to be in the range of $1.75 to $1.90.

- Free cash flow is now expected to be in the range of $450 million to $525 million.

This guidance excludes any unusual items that may occur or additional portfolio or restructuring actions, not specifically identified, as the Company implements plans to further streamline its operations and reduce costs.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global technology company offering innovative products and solutions that enable commerce in the areas of customer information management, location intelligence, customer engagement, shipping and mailing, and global ecommerce. More than 1.5 million clients in approximately 100 countries around the world rely on products, solutions and services from Pitney Bowes.

Source: Pitney Bowes.