RRD Reports Q3 Net Sales of $2.8B, a Decline of 4.4 Percent; Breakup Still on Track

CHICAGO—November 5, 2015—RR Donnelley & Sons Co. (RRD) reported financial results for the third quarter of 2015:

Highlights:

- Third-quarter net sales of $2.8 billion declined 4.4 percent from the third quarter of 2014; organic net sales declined 3.1 percent from the third quarter of 2014

- Third-quarter GAAP net earnings attributable to common shareholders of $14.3 million, or $0.07 per diluted share, compared to GAAP net earnings attributable to common shareholders in the third quarter of 2014 of $62.2 million, or $0.31 per diluted share

- Third-quarter non-GAAP net earnings attributable to common shareholders of $76.0 million, or $0.36 per diluted share, compared to non-GAAP net earnings attributable to common shareholders in the third quarter of 2014 of $78.9 million, or $0.39 per diluted share

- Third-quarter non-GAAP adjusted EBITDA margin of 10.8 percent, compared to non-GAAP adjusted EBITDA margin of 10.6 percent in the third quarter of 2014

- Previously announced plan to create three independent publicly traded companies remains on schedule; expect transactions to be effective October 2016

"We are pleased with our performance during the quarter, given the challenging demand environment. Our continuing focus on matching costs to demand resulted in a non-GAAP adjusted EBITDA margin of 10.8 percent in the quarter, a 20 basis point improvement from the same quarter last year," announced Thomas Quinlan III, RR Donnelley's president and CEO. "Our updated guidance assumes the fourth-quarter demand environment will be similar to what we've experienced throughout the year, and the improvement in margin guidance is reflective of our continuing to manage the business to create value for all of our stakeholders. In addition, we continue to expect free cash flow in the range of $400 million to $500 million, unchanged from our previous guidance."

Net Sales

Net sales in the quarter were $2.8 billion, down $129.8 million, or 4.4 percent, from the third quarter of 2014. After adjusting for the impact of acquisitions and dispositions, as well as changes in foreign exchange rates and pass-through paper, organic sales decreased 3.1 percent from the third quarter of 2014, as modest increases in the Strategic Services and International segments only partially offset declines in the Publishing and Retail Services and Variable Print segments.

GAAP Earnings

Third-quarter 2015 net earnings attributable to common shareholders was $14.3 million, or $0.07 per diluted share, compared to net earnings attributable to common shareholders of $62.2 million, or $0.31 per diluted share, in the third quarter of 2014. The third-quarter net earnings attributable to common shareholders included pre-tax charges of $69.4 million and $22.6 million in 2015 and 2014, respectively, all of which are excluded from the presentation of non-GAAP net earnings attributable to common shareholders.

Non-GAAP Earnings

Non-GAAP adjusted EBITDA in the third quarter of 2015 was $305.2 million, compared to $313.2 million in the third quarter of 2014. Non-GAAP adjusted EBITDA margin in the third quarter of 2015 was 10.8 percent, or 20 basis points higher than in the third quarter of 2014, as productivity improvements more than offset volume declines and price pressure.

Non-GAAP net earnings attributable to common shareholders totaled $76.0 million, or $0.36 per diluted share, in the third quarter of 2015 compared to $78.9 million, or $0.39 per diluted share, in the third quarter of 2014.

2015 Guidance

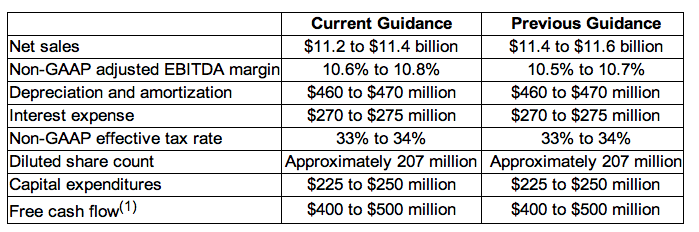

The company provides the following updated full-year guidance for 2015:

About RR Donnelley

RR Donnelley (Nasdaq:RRD) helps organizations communicate more effectively by working to create, manage, produce, distribute and process content on behalf of our customers. The company assists customers in developing and executing multichannel communication strategies that engage audiences, reduce costs, drive revenues and increase compliance. RR Donnelley's innovative technologies enhance digital and print communications to deliver integrated messages across multiple media to highly targeted audiences at optimal times for clients in virtually every private and public sector. Strategically located operations provide local service and responsiveness while leveraging the economic, geographic and technological advantages of a global organization.

Source: RR Donnelley.